How to Trade Stocks with AI Tools

Introduction to AI in Stock Trading

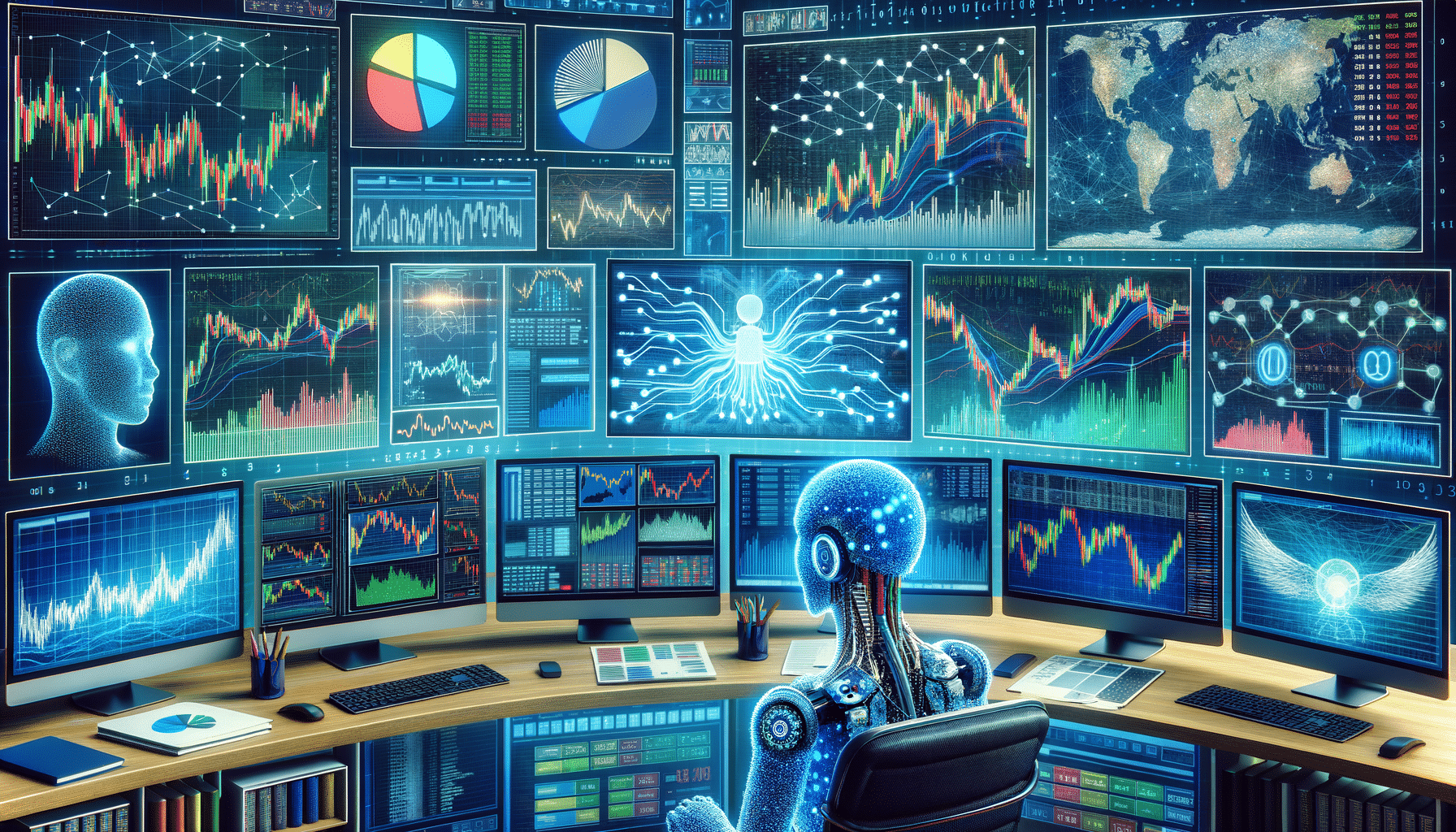

In the fast-paced world of stock trading, the integration of artificial intelligence (AI) tools has become a game-changer. These advanced technologies have revolutionized how traders analyze data, make decisions, and execute trades. With AI, the stock market’s complexities are unraveled, offering traders insights that were once unimaginable.

AI tools in stock trading are designed to process vast amounts of data at lightning speed. They can identify patterns and trends that human eyes might miss, providing a competitive edge in the market. As the financial landscape becomes increasingly digital, the role of AI in trading is not just advantageous but essential for those looking to optimize their strategies and outcomes.

By leveraging AI, traders can enhance their decision-making processes, reduce human error, and improve the overall efficiency of their trading strategies. This integration is not just about staying ahead of the curve; it’s about redefining how trading is done in the modern era.

The Benefits of AI Tools in Trading

AI tools offer numerous benefits to traders, making them invaluable assets in the trading ecosystem. One of the primary advantages is the ability to analyze large datasets quickly and accurately. AI algorithms can process information from multiple sources, such as financial reports, news articles, and social media, to provide comprehensive insights.

Another significant benefit is the reduction of emotional bias in trading decisions. Human traders are often influenced by emotions, which can lead to impulsive decisions. AI tools, on the other hand, rely on data-driven analysis, ensuring that decisions are based on facts rather than feelings.

Moreover, AI tools can automate routine tasks, freeing up time for traders to focus on strategy development and other high-level activities. This automation not only increases efficiency but also allows traders to execute trades at optimal times, potentially leading to better outcomes.

In summary, AI tools enhance trading by providing:

- Data-driven insights and analysis

- Reduction in emotional decision-making

- Automation of routine tasks

- Improved trading efficiency and outcomes

Challenges and Considerations

While AI tools offer numerous advantages, they also present certain challenges that traders must consider. One of the primary concerns is the reliance on data quality. AI algorithms are only as good as the data they analyze. Poor-quality data can lead to inaccurate predictions and potentially costly mistakes.

Additionally, the implementation of AI tools requires a significant investment in technology and training. Traders need to be familiar with how these tools work and understand their limitations to use them effectively. This learning curve can be steep, especially for those new to AI technologies.

Another consideration is the ethical implications of AI in trading. As these tools become more sophisticated, there is a risk of market manipulation and other unethical practices. It’s crucial for regulatory bodies to establish guidelines to ensure that AI is used responsibly and transparently in the trading industry.

In conclusion, while AI tools offer substantial benefits, traders must navigate challenges related to data quality, investment in technology, and ethical considerations to fully leverage their potential.

Conclusion: Embracing AI in Trading

The integration of AI tools in stock trading represents a significant advancement in the financial industry. These technologies provide traders with powerful tools to analyze data, automate processes, and make informed decisions. However, with these benefits come challenges that require careful consideration and management.

As the trading landscape continues to evolve, embracing AI tools will be crucial for traders looking to stay competitive and achieve success. By understanding the capabilities and limitations of AI, traders can harness these technologies to enhance their strategies and optimize their trading outcomes.